ECONOMY: UNEMPLOYMENT RATE DOWN IN Q3

Tulsa’s economy has been stable but facing headwinds in early 2025. Statewide

nonfarm employment continues to grow, with Oklahoma’s manufacturing

exports rising 6.6% in the first four months year-over-year.

The unemployment rate decreased 0.2% from Q2 to Q3 2025 to 3.0% (1.3%

below the U.S. rate and down 0.4% year-over-year (YOY). The current

workforce decreased from 489,900 to 478,200 (up 6,000 YOY). Low rents,

energy costs, and taxes help to make the cost of doing business in Tulsa is

lower than the national average.

DEMAND: STABLE INTO Q4 2025

Through the first three quarters of 2025, office demand in Tulsa has remained

muted but stable, characterized by a cautious leasing environment and

selective absorption. While net absorption has been modest, demand continues

to favor Class A and fully renovated space as tenants seek quality and flexibility.

Local reports indicate that office availability has held relatively steady, and

tenant improvement allowances and concessions remain pervasive—

undermining growth in effective rents.

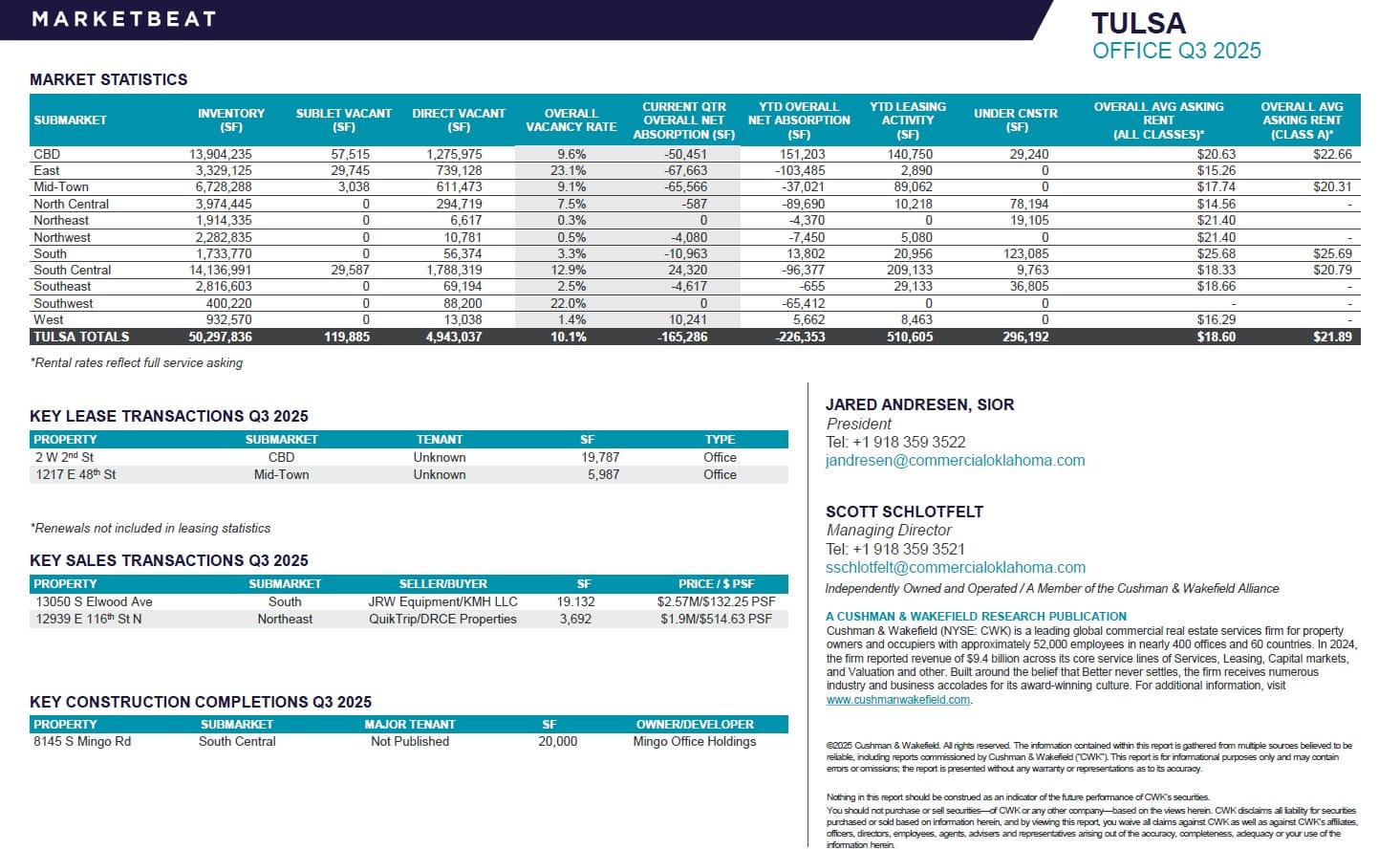

With demand holding stable, asking rents continue to rise, growing 2.0% over

the past 12 months. Market asking rents come in at $18.60 per square foot

(psf), slightly below neighboring Oklahoma City with rents of $20.00/psf.

PRICING: CBD RATES ON THE RISE INTO Q4 2025

The Tulsa total office market experienced a modest $0.02 psf increase in

average rental rates during the quarter, closing at $18.60 psf, representing a

$0.56 YOY gain. The Central Business District (CBD) recorded a more notable

$1.27 YOY increase, reaching $20.63 psf, while the Non-CBD submarket

declined $0.04 from Q2 to $17.43 psf, though still reflecting a $0.07 YOY

increase.

The highest rents are found in the metro area outside of the CBD. The South

submarket has the highest Class A asking rent at $25.68 psf, followed by the

CBD at $22.66 psf.

Market participants report that landlords continue to offer concessions and

tenant improvement (TI) packages, which are dampening effective rent growth

despite nominal rate increases.