ECONOMY:

Oklahoma City hosts a number of prominent companies, including Fortune 500 leaders

Devon Energy, Continental Resources, and Love’s Travel Stops, along with Fortune 100

tech firm Paycom. These key players in energy, retail, and technology showcase the city’s

expanding and diverse economy. While energy continues to be a foundational industry, OKC

is experiencing strong growth in aerospace, technology, and manufacturing, with major

expansions from companies like Boeing, Skydweller Aero, and Costco.

The city’s favorable business climate, highly skilled workforce, and economic incentives—

such as the Strategic Investment Program offered by the Oklahoma City Economic

Development Trust—make it an attractive destination for employers. As a result, OKC

consistently posts an unemployment rate below the national average. Population growth in

Oklahoma and Canadian counties has also driven an 18% increase in the metro area since

2010, outpacing Tulsa’s 11%.

DEMAND:

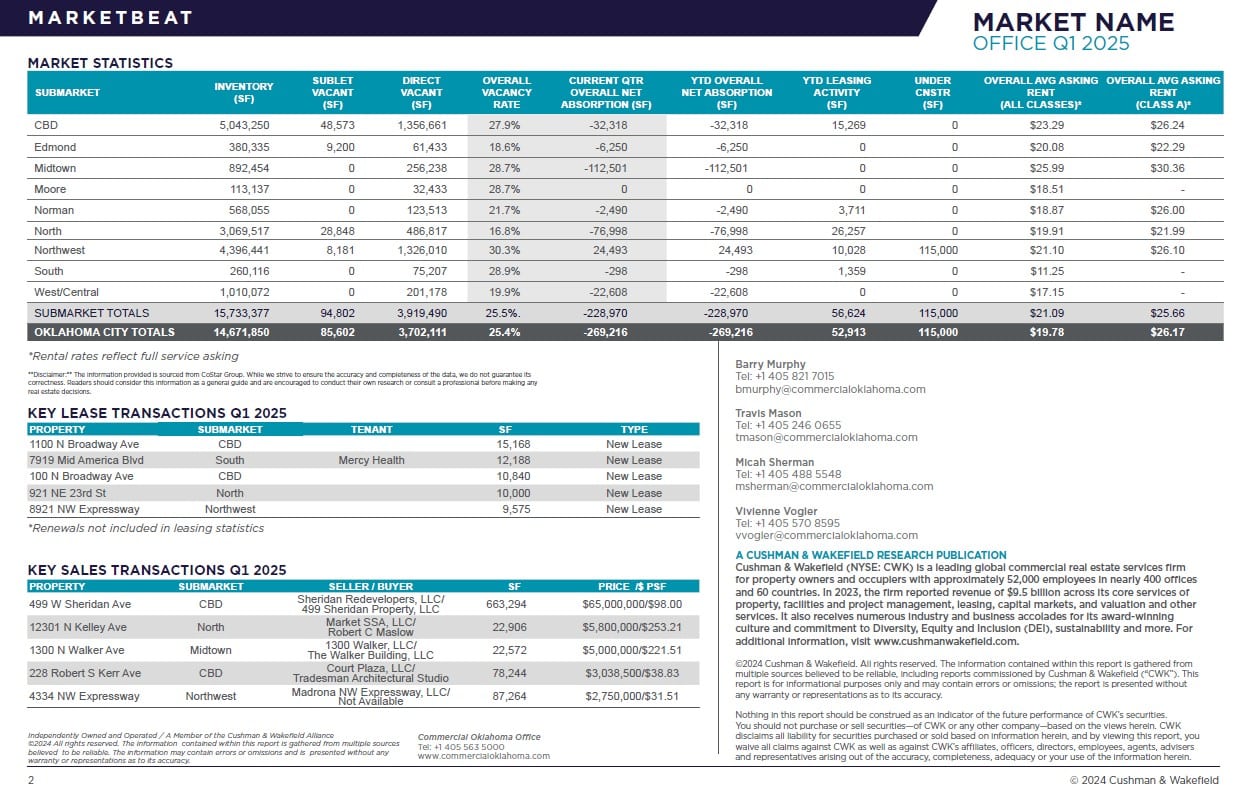

The Oklahoma City office market continues to fluctuate , with rising vacancies and

fluctuating interest rates contributing to a cautious environment. As tenants continue to

downsize—averaging around 2,500 square feet—larger office spaces are staying on the

market longer than in the pre-pandemic era. Still, vacancy rates and average asking rents

remain ahead of national averages, as seen in Q1 2025.

Demand is holding steady, particularly in the finance, tech, insurance, energy, and public

sectors, which are largely concentrated in the North and Northwest submarkets. These areas

account for over half of all leasing activity, thanks to a strong mix of options, easy access,

and proximity to affluent, highly educated neighborhoods. Meanwhile, older buildings—

especially those constructed before 1980—are seeing increased vacancy, as tenants favor

modern, updated spaces with various amenities. The Northwest & Midtown submarkets lead

in new development, with 115,000 square feet of office space currently under construction.

OUTLOOK:

Oklahoma City’s office market continues to favor tenants, with rising inventory and stagnant

demand keeping rent growth flat. Slow absorption has led landlords to offer increased

tenant improvement packages—nearly double pre-pandemic levels—and added concessions

to drive occupancy.

Weakened demand and high interest rates have further slowed deal activity, widened the

pricing gap between buyers and sellers, and contributed to declining property values and

higher cap rates. As supply continues to grow and demand remains inconsistent, landlords

are increasingly open to negotiations, leading to modest gains in an otherwise cautious and

evolving market.