ECONOMY:

Oklahoma City’s economy remains strong and steadily growing, supported by a diverse

mix of industries. While energy and the private sector continue to serve as key pillars, the

metro is experiencing rapid expansion in aerospace, technology, and manufacturing, driven

by major investments from companies like Boeing, Skydweller Aero, and Costco. A probusiness

environment, skilled labor force, and competitive state incentives have helped

attract new employers and fuel corporate growth, keeping unemployment low at 3.1%—well

below the national average—and driving job growth that consistently outpaces the U.S.

rate. The city is home to major companies such as Devon Energy, Continental Resources,

Paycom, and Love’s Travel Stops, reflecting a growing presence across energy, finance, and

retail sectors. Population growth has further bolstered the economy, with the metro area

expanding by 18% since 2010—well ahead of Tulsa’s 11%—led by gains in Oklahoma and

Canadian Counties, reinforcing the city’s appeal to both businesses and residents.

DEMAND:

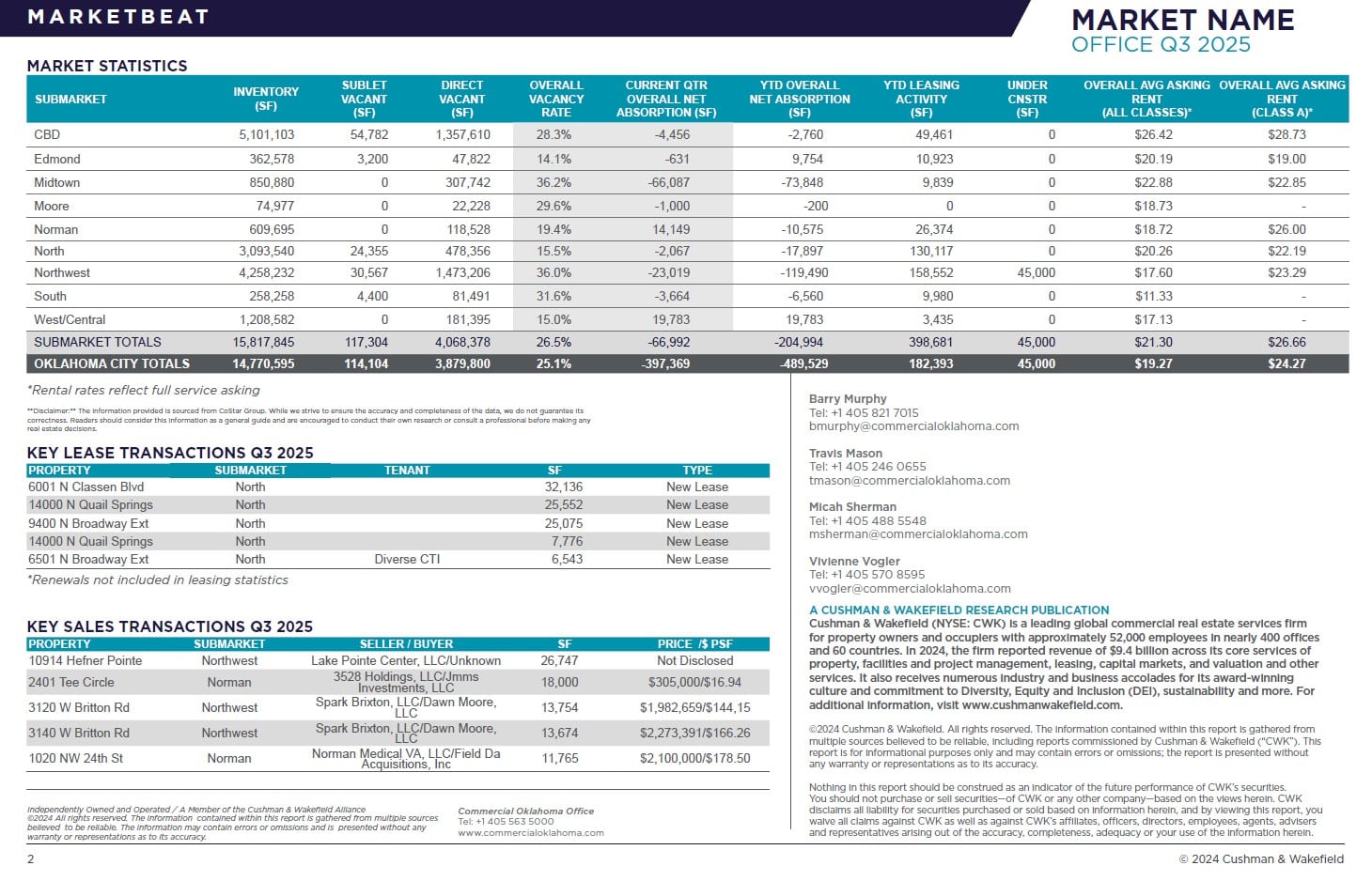

Compared to peer cities of similar size, Oklahoma City’s office market stands out for its

resilience and consistent tenant interest. This strength is largely driven by business-friendly

policies, cost-effective lease rates, and a measured pace of new development. Office

properties in the metro tend to lease more quickly than the national norm, averaging

around 12 months on the market versus over 14 months nationwide. Average asking

rents remain highly competitive at $20.18 per square foot—well below the U.S. average

of $35.93—making the market particularly attractive. Key industries driving this demand

include government, finance, tech, insurance, and energy, with much of the activity

centered in the North and Northwest corridors, where updated buildings and access to

talent are top draws. With its affordability, steady economic base, and lack of overbuilding,

Oklahoma City continues to offer one of the most stable office environments in the

country.

OUTLOOK:

Oklahoma City’s office market is evolving in response to shifting tenant preferences, with

demand increasingly focused on smaller, high-quality spaces—particularly in the North

and Northwest submarkets, which account for roughly 40% of leasing activity due to

their desirable locations. To stay competitive, landlords are enhancing their offerings by

increasing the proportion of building common areas, allowing for more shared amenities

that appeal to today’s tenants. Although vacancy rates remain elevated, steady leasing

activity is being supported by tenant-favorable pricing and more generous tenant

improvement (TI) packages. On the investment side, softening interest rates are narrowing

the gap between buyer and seller expectations, leading to more balanced negotiations

and improved deal flow. Redevelopment opportunities continue to attract investors, with

office-to-multifamily conversions and owner-occupied acquisitions becoming increasingly

common across the metro. As interest rates are projected to continue declining in the

coming months, investment activity is expected to pick up further. Looking ahead, vacancy

is likely to decrease as underutilized office space is repurposed, setting the stage for a

more stable and dynamic market environment.