ECONOMY:

Oklahoma City’s economy remains steady, supported by an evolving mix of industries.

While energy and the private sector continue to be foundational, the metro is experiencing

notable growth in aerospace, technology, and manufacturing, fueled by major investments

from companies like Boeing, Skydweller Aero, and Costco. The city’s pro-business

environment, skilled labor pool, and competitive state incentives continue to attract

new employers and support expansion. The current unemployment rate sits at 3.1%,

outperforming the national average of 4.1%, and year-over-year job growth for Q2 reached

1.5%, also ahead of the U.S. average. The region’s population growth continues to reflect

this momentum, with a Q2 increase of 0.94% compared to the national rate of 0.75%,

resulting in a net population gain of 13,974 residents. Anchored by major employers such

as the State of Oklahoma and Tinker Air Force Base, which together employ over 69,000

people, Oklahoma City remains well-positioned for long-term economic resilience and

opportunity.

DEMAND:

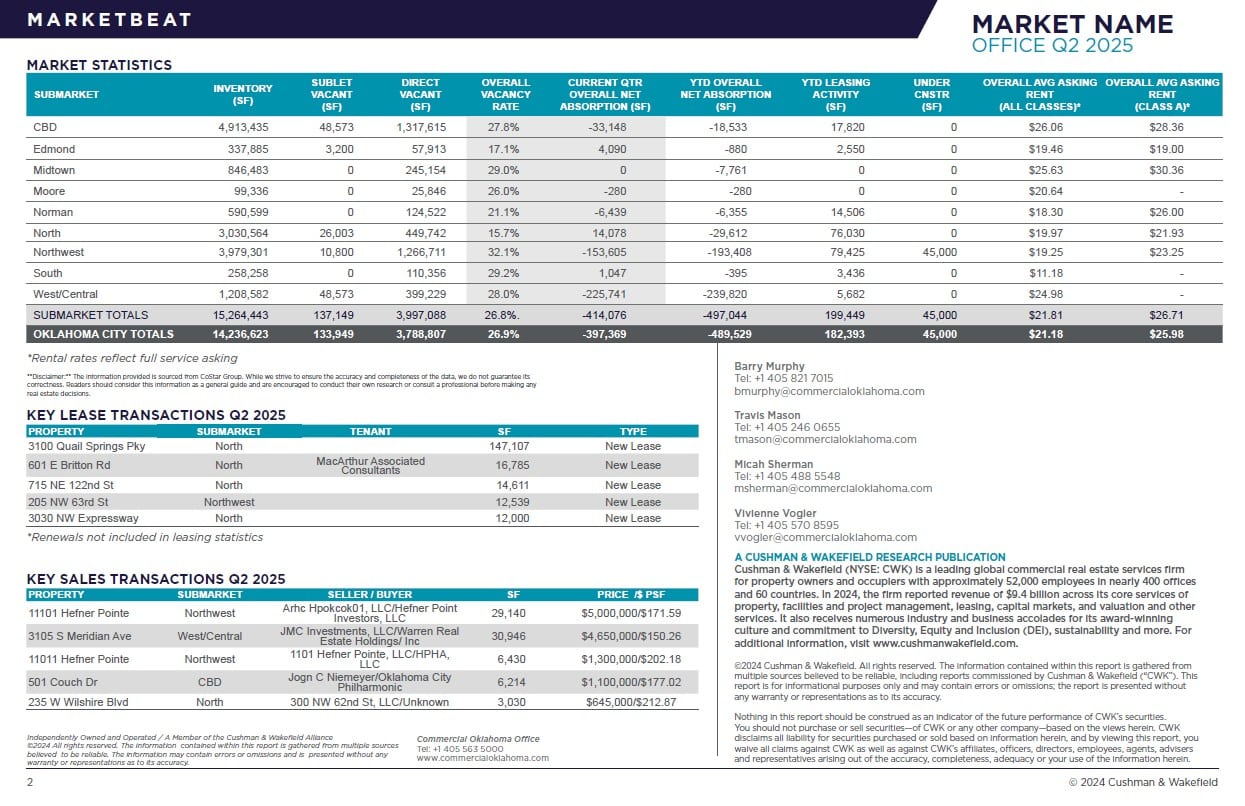

Oklahoma City’s office market shows strong demand and stability compared to

similar-sized cities, fueled by a pro-business climate, affordable rates, and limited new

construction. Office space in Oklahoma City also experiences a shorter leasing cycle,

with an average market duration of 12.5 months compared to the national average of 14.4

months, supported by competitive rental rates of $21.18 per square foot versus $35.57

nationally. Demand is especially strong in the government, finance, tech, insurance, and

energy sectors, concentrated in the North and Northwest submarkets, where updated

spaces and access to skilled talent attract tenants. Together, OKC’s affordability, economic

growth, and disciplined development make it one of the nation’s more resilient office

markets.

OUTLOOK:

Oklahoma City’s office market is adapting to changing tenant demands, with leasing

shifting toward smaller, higher-quality spaces, especially in the North and Northwest

submarkets, which attract 40% of activity due to their prime locations. While vacancy

remains elevated, tenant-friendly pricing and increased TI incentives are helping maintain

steady leasing momentum. Although high interest rates have slowed deal activity, widened

the pricing gap between buyers and sellers, and contributed to declining property values

and higher cap rates, opportunistic buyers continue to invest in redevelopment and owner occupied

properties. Looking ahead, vacancy rates are expected to decline as more office to

multifamily conversions take place, signaling a positive path toward market stabilization

and renewed growth.